Health insurance is a crucial aspect of financial planning and healthcare management. It provides financial protection and peace of mind, helping you cover medical expenses when you need it most. However, understanding the cost of health insurance can be a daunting task, with various factors influencing the premiums you pay. In this comprehensive guide, we’ll explore the factors affecting health insurance costs and provide valuable insights to help you make informed decisions.

Factors Influencing Health Insurance Costs

When determining how much health insurance costs, several factors come into play:

Type of Plan

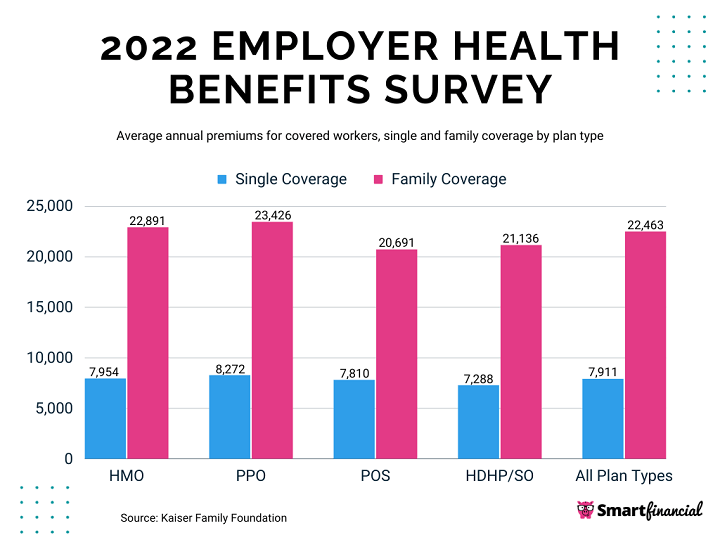

- Health insurance plans vary, with options like Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs). The type you choose affects your premiums.

Coverage Level

- Your choice of coverage, such as individual, family, or group plans, will impact your costs.

Age

- Age is a significant factor in health insurance pricing. Younger individuals often pay lower premiums, while older individuals typically pay more.

Location

- The cost of healthcare services varies by location. Urban areas tend to have higher premiums compared to rural areas.

Health History

- Your personal health history and pre-existing conditions can influence the cost of your health insurance.

Lifestyle Habits

- Certain lifestyle choices, like smoking or excessive alcohol consumption, can result in higher premiums.

Deductible and Copayments

- Higher deductibles and copayments can lower your premiums but may result in higher out-of-pocket costs when you need care.

Employer Contributions

- If you have employer-sponsored health insurance, your employer’s contributions can significantly impact your costs.

Understanding Health Insurance Premiums

Health insurance premiums are the regular payments you make to your insurance provider. Here’s what you need to know:

Monthly Premiums

- Most health insurance plans require monthly premium payments, which can vary widely based on the factors mentioned above.

Annual Premiums

- Consider the total annual cost of your premiums, as this can provide a more comprehensive perspective on your health insurance expenses.

Premium Subsidies

- Depending on your income and the type of plan you choose, you may be eligible for premium subsidies through government programs like the Affordable Care Act.

Additional Costs

In addition to premiums, there are other costs associated with health insurance:

Deductibles

- A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often mean lower monthly premiums.

Copayments

- Copayments are fixed fees you pay for specific services, such as doctor visits or prescription medications.

Coinsurance

- Coinsurance is the percentage of costs you must cover for certain services after reaching your deductible.

Shopping for Affordable Health Insurance

To find an affordable health insurance plan:

Compare Quotes

- Obtain multiple quotes from different insurers to find the best rates for your desired coverage.

Consider Your Needs

- Assess your healthcare needs and choose a plan that aligns with your requirements.

Evaluate Network Providers

- Ensure that your preferred healthcare providers are in-network to save on costs.

Utilize Health Savings Accounts (HSAs)

- Consider plans that allow contributions to tax-advantaged HSAs to save on future medical expenses.

Review Preventive Care Coverage

- Plans covering preventive care can save you money by addressing health issues before they become costly problems.

“How much is health insurance?” is a complex question with no one-size-fits-all answer. Various factors, including the type of plan, your age, and your health history, can impact your insurance costs. It’s crucial to carefully evaluate your options, compare quotes, and choose a plan that provides the coverage you need at a price you can afford. By understanding the factors influencing health insurance costs, you can make informed decisions that ensure you have the necessary protection for your health and financial well-being.