Establishing a solid business credit profile is crucial for the growth and sustainability of your company. It not only enhances your financial credibility but also opens up opportunities for financing, partnerships, and vendor relationships. In this comprehensive guide, we’ll walk you through the steps to build business credit effectively.

Understanding Business Credit:

Before diving into the process, it’s essential to grasp the concept of business credit and its significance.

- What is Business Credit?

- Business credit refers to a company’s creditworthiness and financial history, distinct from personal credit.

- Why Is Business Credit Important?

- It allows your business to access capital, secure favorable terms with suppliers, and foster trust among partners and investors.

- Key Differences Between Personal and Business Credit:

- Personal credit is linked to individuals, while business credit is tied to your company.

- Your personal assets are separate from your business assets with proper business credit.

Establishing the Foundation

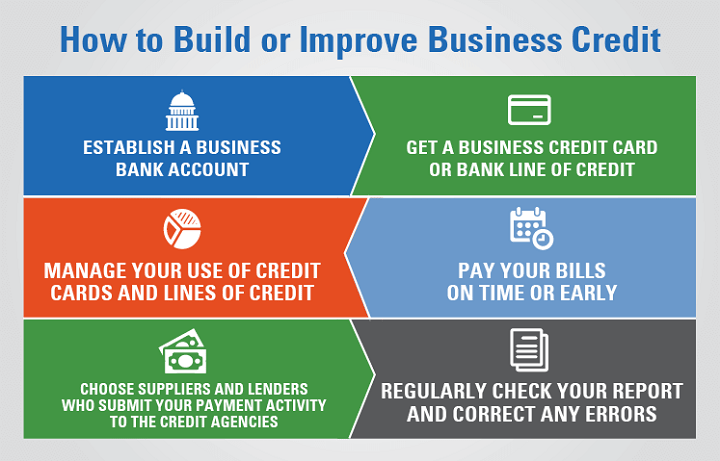

Creating a strong credit foundation is the first step in building your business credit score.

- Register Your Business:

- Choose the right business structure (e.g., LLC, corporation) and obtain an Employer Identification Number (EIN).

- Open a Business Bank Account:

- Maintain separate personal and business accounts to avoid commingling funds.

- Obtain Necessary Licenses and Permits:

- Ensure your business complies with local and state regulations.

Building Business Credit

Now that your business has a solid foundation, it’s time to focus on building credit.

- Apply for a D-U-N-S Number:

- Dun & Bradstreet provides a unique identifier for your business, which is widely used by creditors and lenders.

- Establish Vendor Credit:

- Work with suppliers who report your payment history to business credit bureaus.

- Secure a Business Credit Card:

- Use a business credit card and make timely payments to build your credit score.

- Monitor Your Credit Report:

- Regularly check your business credit report for inaccuracies and address any issues promptly.

Responsible Credit Management:

Once you have started building credit, managing it wisely is essential.

- Pay Bills on Time:

- Consistently pay your business bills and debts by the due date.

- Maintain a Low Credit Utilization Ratio:

- Keep your credit card balances low to demonstrate responsible credit management.

- Avoid Overextending Your Credit:

- Don’t take on more debt than your business can handle.

- Set Up Payment Reminders:

- Use tools or reminders to ensure timely payments.

Expanding Your Credit Profile:

As your business grows, consider expanding your credit options.

- Seek Additional Financing:

- Apply for loans or lines of credit to increase your credit profile.

- Explore Business Credit Builder Programs:

- Some organizations offer programs to help small businesses build credit.

- Diversify Your Credit Mix:

- Use different types of credit, such as loans and credit cards, to showcase your ability to manage various financial obligations.

Network and Collaborate:

Networking and collaboration can positively impact your business credit.

- Build Strong Business Relationships:

- Nurture partnerships, as positive references can influence your creditworthiness.

- Communicate with Creditors:

- If you face financial difficulties, keep your creditors informed and work on solutions to avoid negative credit marks.

Continual Monitoring and Improvement

Regularly monitoring and improving your business credit is an ongoing process.

- Review Your Credit Report:

- Check your credit report regularly and dispute any inaccuracies.

- Update Financial Statements:

- Provide up-to-date financial information to credit bureaus.

- Maintain Financial Responsibility:

- Continue practicing responsible credit management.

Building business credit is a strategic endeavor that can significantly benefit your company’s financial stability and growth. By following the steps outlined in this comprehensive guide, you can establish and maintain a strong business credit profile, opening doors to a world of financial opportunities for your business.